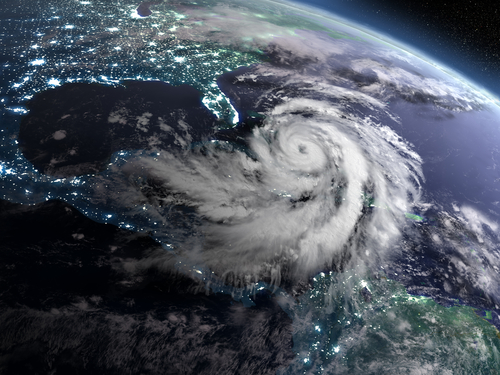

Florida's Hurricane Season Update For Homeowners

As the 2025 Hurricane season, which runs from June 1 to Nov. 30, approaches, homeowner insurance may get harder and more expensive to purchase. While the decade long insurance crisis is stabilizing in the state, Florida is still a tricky state to get affordable coverage, particularly during hurricane season.

Here is a quick overview of what you need to know about homeowners coverage in Florida during the Hurricane Season.

While coverage is still very expensive in Florida, experts claim that the homeowners insurance market has started to stabilize as legislation takes effect. While many insurers have left the Florida market altogether, new insurance companies have recently started writing policies in the state.

While premiums are still expected to rise this year, it will most likely go up at a slower pace due to the recently passed legislation.

“The Florida homeowners insurance crisis is the result of several factors, including hurricanes and litigation, that have caused home insurance companies to pull back, leave the state or even go out of business. As new legislation starts to impact rates and new companies enter the market, the crisis appears to be easing,” said Insurance.com’s March 2025 report.

While the market is stabilizing, homeowners coverage can be difficult, and it is not something that you should wait until the last minute to put in place.

Once a storm headed towards the state has been named, insurers typically stop selling coverage so coverage must be in place well before a storm is headed toward your home. Each insurer has their own regulations in place for when they stop writing coverage so make sure you fully understand your policy, coverage levels and insurer terms regarding changing or adding coverages.

In addition, flood insurance comes with 30 day waiting period in most cases which means coverage will not kick in until a month after the policy is purchased. This means that adding flood insurance to your policy as a hurricane bears down on your home is usually not possible.

A typical homeowners insurance policy excludes flood damage so carrying a flood insurance policy is a necessity if your home has any risk of being flooded. Hurricanes often bring extensive flood damage that will not be covered if you are not carrying flood insurance.

Insurers have also started selling policies with separate windstorm or hurricane deductible that kick in when damage is done by winds or hurricane damage. These are often percentage deductibles which means your deductible is a percentage of your total coverage levels.

As an example, if you are carrying $350,000 with a 3% deductible you would need to cover $10,500 before your coverage kicks in to pay the balance.

It is important to read your policy in full and make sure you have a complete understanding of your coverages and just as important, any exclusions from coverage. If you find gaps in your coverage you should consider putting additional coverages in place if necessary.

Related Florida News

- Florida Homeowners Insurance Market Outlook for 2026

- Florida's Homeowners Insurance Crisis and Why the Recent Rate Cuts Matter

- Florida Property Insurance Companies are Profiting. Do homeowners get a refund?

- Competition Increases as Two New Property Insurers Start in Florida

- Florida Tops #1 for Homeowner Insurance Non-Renewals